are political contributions tax deductible for a business

In most states you cant deduct political contributions but four states do allow a tax break for political campaign contributions or donations made to political candidates. Arkansas Ohio and Oregon offer a tax credit while Montana offers a tax deduction.

Sample Christmas Donation Postcards Examples Of Donation Cards Http Pfa Blog Com Home 3 Examples Of Card Template Card Templates Free Small Business Cards

All four states have rules and limitations around the tax break.

. The performance is normally open to the public for 100 a ticket. A campaign committee A newsletter fund A political party Political Action Committee. The agency also bans businesses from deducting political expenses.

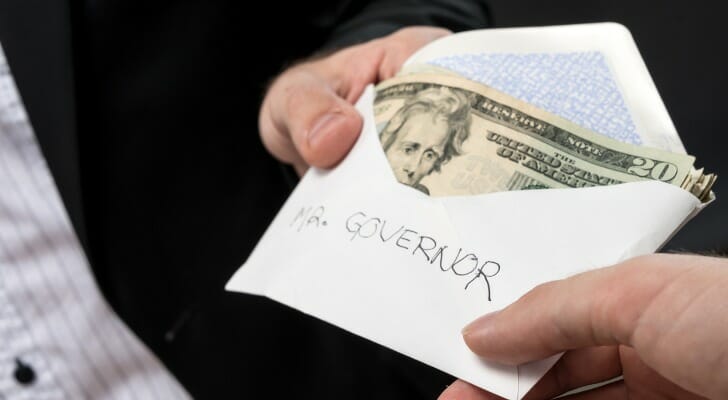

Charitable contributions are usually tax-deductible but political contributions are an exception to this rule. Advertisements in a political convention program or politically affiliated publication. To help individuals and businesses discern what is or is not tax-deductible the IRS has a tool called the Tax-Exempt Organization Search.

20 of 400 contribution 80. These are not tax-deductible contributions if you donate to a political party campaign or political action committee. Are political donations tax-deductible for business.

Cost of admission to a political event including. Most political contributions whether local regional or national are not tax deductible and havent been for years. Payment for any of these cannot be deducted from your taxes.

Here are other examples of items that Uncle Sam stipulates that one cannot deduct. So at this stage. Can An Llc Donate To A Political Campaign In Pennsylvania.

Payments made to the following political causes are also not tax deductible. You can only claim deductions for contributions made to qualifying organizations. These business contributions to the political organizations are not tax-deductible just like the individual donations and payments.

Contributions or expenditures made by a taxpayer engaged in a trade or business designed to encourage the public to register and vote in federal state and local elections and to contribute to the campaign funds of the candidate or party of their choice are deductible by the taxpayer under section 162 a of the internal revenue code of 1954. So if you happen to be one of the many people donating to political candidates campaign funds dont expect to deduct any of those contributions on your next tax return. The simple answer to whether or not political donations are tax deductible is no.

All contributions donations or payments to political organizations are not tax-deductible. The answer is no as Uncle Sam specifies that funds contributed to the political campaign cannot be deducted from taxes. 116-25 Section 3101 requires electronic filing by exempt organizations in tax years beginning after July 1 2019.

Businesses may be interested in political outcomes but will not be able to deduct expenses related to political campaigns. The IRS guidelines also go beyond just direct political contributions. Any money voluntarily given to candidates campaign committees lobbying groups and other political organizations is non-deductible as per the IRS.

A political contribution is not often regarded as a viable expense in a business and therefore cannot be deductedEven if you write checks to a political party there are a lot of ways to financially support a cause without writing a check toward your tax bill. Therefore the benefit Bernie receives is 100 which is less than the limit of 150. A business tax deduction is valid only for charitable donations.

In a nutshell the quick answer to the question Are political contributions deductible is no. However there are still ways to donate and plenty of people have been taking advantage of. Contributions or donations that benefit a political candidate party or cause are not tax deductible.

The Taxpayer First Act Pub. And the same goes for a business return. Its Written Into the Tax Code The Internal Revenue Service IRS also specifically says political contributions cannot be treated as deductions on individual tax returns.

The political organization taxable income equals its gross income excluding exempt function income less deductions allowed by the Code that are directly connected with producing gross income excluding exempt function income computed with certain modifications set forth in 527 including a specific deduction of 100. Among other provisions this legislation specifically amended IRC Section 527 j to require the e-filing of Form 8872 Political. However the value of the benefit must not be more than 20 of his contribution.

Political contributions deductible status is a myth. Required electronic filing by tax-exempt political organizations. This doesnt just mean that donations made to candidates and campaigns are excluded from being tax deductible.

Ticket price 400 benefit 100 300 tax deduction. That includes donations to. The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified to receive tax-deductible donations.

People who make political contributions often think that they count as charitable contributions. To be precise the answer to this question is simply no.

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Write Offs For The Self Employed For All The Visual Learners Out There This Board Is For You We Ve C Rowing Workout Rowing Machine Workout Machine Workout

Are Political Contributions Tax Deductible H R Block

Are Political Contributions Tax Deductible Smartasset

Are Political Contributions Tax Deductible Anedot

36 Free Donation Form Templates In Word Excel Pdf In Donation Cards Template Cumed Org Donation Form Sponsorship Form Template Card Template

Are Political Contributions Tax Deductible Smartasset

Are Political Contributions Tax Deductible Taxact Blog

Are Political Donations Tax Deductible Credit Karma Tax

A New Report From The Nonprofit Nonpartisan Tax Foundation Indicates Only France S 36 Percent Corporate Tax Rate Is Hig Tax Deductions Income Tax Filing Taxes

Donation Receipt Receipt Donate Receipt Template

Are Political Contributions Tax Deductible H R Block

Are My Donations Tax Deductible Actblue Support

Are Political Contributions Tax Deductible

Are Political Donations Tax Deductible Uk Ictsd Org

Reducing Tax Burden Different Sections Like 80c 80d Etc Detailed Infographic By Livemint Incometax Public Provident Fund Tuition Fees Tax Deductions

Say No To Cash Transaction In 2021 Cash Prevention Accounting

Are Political Contributions Tax Deductible For Partnerships Ictsd Org